Free online billpay, mobile check deposits, and e-statements available with all New Valley banking accounts; your bank for small businesses in Massachusetts.

Flex Checking

- $10 minimum to open

- Non-interest-bearing account

- No monthly maintenance service charge

- Unlimited check writing

- Free first order of standard wallet style checks

- Up to $20 of ATM surcharges rebated monthly

Capital Checking

- $10 minimum to open

- Interest-bearing account

- Unlimited check writing

- $75 Credit toward first order of checks

- Up to $20 of ATM surcharges rebated monthly

- $10 monthly maintenance service charge easily waived with $25,000 daily balance minimum or $50,000 in related deposits or loans

Platinum Checking

- $100 minimum to open

- $25 monthly maintenance service charge

- Monthly earnings credit rate to offset service charges*

- First 20 checks per statement cycle paid at no charge

- $75 credit toward first order of checks

- Up to $20 of ATM surcharges rebated monthly

*See Commercial Analysis Schedule of Fees for additional charges.

Not For Profit Checking

- $10 minimum to open

- Interest-bearing account

- No monthly maintenance service charge

- Unlimited check writing

- $75 credit toward first order of checks

- Up to $20 of ATM surcharges rebated monthly

Free online banking, mobile check deposits, and e-statements available with all New Valley accounts.

Business Savings

- $10 minimum to open

- Interest-bearing account

- $5 monthly maintenance service charge easily waived with $500 daily balance

Business APEX Money Market

- $10 minimum to open

- Tiered interest rate account

- Account requires a business checking account

- No monthly maintenance service charge

- E-statements required to avoid paper statement fee*

*$3.00 fee for paper statements. This fee will be waived for the first two statement cycles. No monthly statement fee is charged on accounts receiving e-statements.

Commercial Money Market

- $10 minimum to open

- Tiered interest rate account

- $20 monthly maintenance service charge easily waived with $10,000 daily balance

Municipal Money Market

- $10 minimum to open

- Tiered interest rate account

- $20 monthly maintenance service charge easily waived with $10,000 daily balance

Not For Profit Savings

- $10 minimum to open

- Interest-bearing account

- $5 monthly maintenance service charge easily waived with $500 daily balance

Cash Management Sweep

- Optimize your cash flow by getting higher returns on cash that might otherwise languish in your checking account

- Automate processes by linking your checking account to our sweep product and set predetermined balances to help you maximize your earnings

- Money is conveniently swept back into your account when you need it most

Zero Balance Account

- Zero Balance Accounts are designed for companies that maintain a general operating account and separate accounts for other purposes (payroll, petty cash, etc.)

- Disbursements are made from subsidiary accounts, which always maintains a zero balance or other user defined balance. This account system allows the company increased investment opportunities and reduced administrative expense.

ACH Origination

- Originate ACH Transactions easily from our secure digital platform

- Create best practice internal controls via multi-layered authorizations

Online Wire Services

- Initiate wire transfers for same day payments easily from our secure platform

- Receive domestic or international wires into your account

Remote Deposit Capture

- Business customers can securely and electronically submit checks for deposit without ever leaving the office

- Deposit to multiple accounts within the same session

- Reduce risk and save time by eliminating bank-runs

Online Banking Account Management

- Establish individual account access levels, including Information Reporting, ACH Originations, Wire Transfers and BillPay

- Limit what users can view- such as details of one account, allow your accountant to view details of all accounts and make payments from a selected account, etc.

- Manage accounts for multiple businesses with one Online ID

- Transfer funds between different business entity accounts linked to your profile

- Perform all your online banking directly within QuickBooks and Quicken

Positive Pay – Check or ACH

- Automated fraud detection tool, NVB&T offers to help you feel secure about your accounts

- Compares each check presented for payment against check issue file and identifies checks that don’t match. View images of check exceptions and decide which items to pay and return.

- ACH Block service prohibits unauthorized ACH activity on your account

Credit Card

Our Platinum credit cards offer hometown convenience, worldwide acceptance and great benefits.

Apply Online

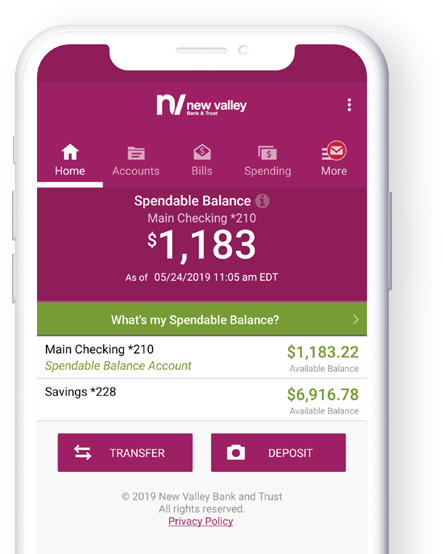

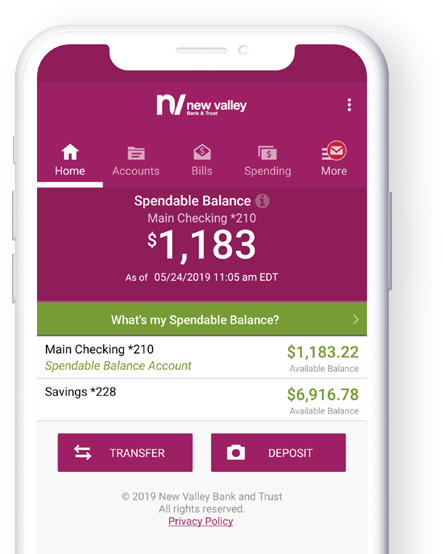

Digital Banking

Our app and digital banking tools are easy-to-use and give you 24/7 access, but when you need in-person assistance, give us a call and we’re on our way—often literally.

Go Mobile with New Valley Bank

We’re here to help you access all of your online banking needs 24/7 right from the palm of your hand. Our mobile banking app allows you to deposit checks, transfer funds, and make simple transactions from the comfort of your house, office, or anywhere you happen to be. With mobile banking, managing your finances is more convenient than ever before with your premier bank for small business in Massachusetts.

Download our free App today

Available for iPhone and Android Devices. If you are not a current online banking user, please enroll first.

Business Accounts

Our accounts have competitive rates and terms placing us among the best banks for small business in Massachusetts—and our high-touch customer service makes banking one less thing to worry about.

Become a Rise Partner

As a Rise Partner, your employees will enjoy affordable banking right at your place of business, with easier access to their paycheck via a Rise Account, or any other New Valley bank account.

- Dedicated NVRise specialist to assist your employees

- On-site account opening

- Check-free debit account with a $7 monthly fee

- ATM surcharge rebates up to $10