Free online BillPay, mobile check deposits, and e-statements—all available with a New Valley personal bank account.

Monarch Checking

Bank like royalty.

- $10 minimum to open

- Blended interest rate account

- No monthly maintenance service charge

- Active debit card required

- All ATM surcharges rebated monthly

- E-statements required to avoid paper statement fee*

*$3.00 fee for paper statements. This fee will be waived for the first two statement cycles. No monthly statement fee is charged on accounts receiving e-statements.

Signature Checking

Higher yields for higher balances.

- $10 minimum to open

- Interest-bearing account

- Free wallet style check orders

- Free money orders and official bank checks

- All ATM surcharges rebated monthly

- $14.95 monthly service charge easily waived with $5,000 minimum daily balance or $25,000 in related deposit balances

Direct Checking

Earn while making payments.

- $10 minimum to open

- Interest-bearing account

- First order of standard wallet style checks

- Up to $20 of ATM surcharges rebated monthly

- $10 monthly service charge easily waived with $1,000 daily balance minimum or $10,000 in related deposit balances

True Checking

Banking made simple.

- $10 minimum to open

- Non-interest-bearing account

- No monthly maintenance service charge

- Free first order of standard wallet style checks

- Up to $20 of ATM surcharges rebated monthly

Free online banking, mobile check deposits, and e-statements— all available with a New Valley personal bank account.

APEX Money Market

Peak rates for your savings.

- $10 minimum to open

- Tiered interest rate account

- Account requires a Monarch Checking account

- No monthly maintenance service charge

- E-statements required to avoid paper statement fee*

*$3.00 fee for paper statements. This fee will be waived for the first two statement cycles. No monthly statement fee is charged on accounts receiving e-statements.

Money Market Account

A checking-savings hybrid that fits your lifestyle.

- Tiered variable interest rate account

- $10 monthly service fee easily waived with $2,500 minimum daily balance or $10,000 related deposit balance

Benchmark Savings

Set your goal and begin saving.

- No monthly service charge

- Interest bearing account

Certificates of Deposit

Score higher returns with a safe, short-term investment.

- $500 Minimum to open

- 6 month CD

- 12 month CD

- 18 month CD

- 24 month CD

- 36 month CD

- 48 month CD

- 60 month CD

Penalties may be assessed on premature withdrawals; terms & conditions apply — see account disclosure for details.

Credit Card

Our Platinum credit cards offer hometown convenience, worldwide acceptance and great benefits.

Apply Online

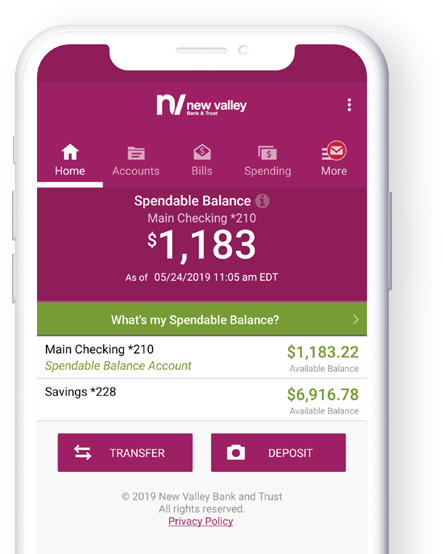

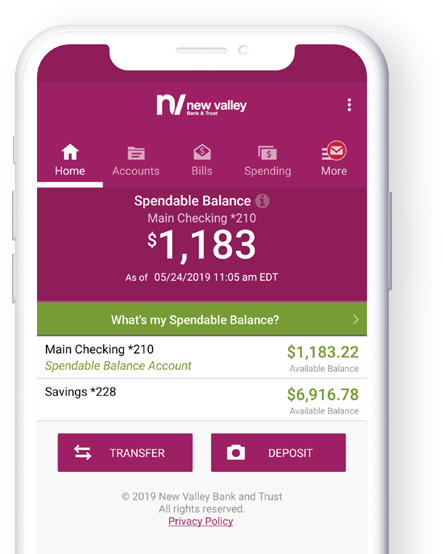

Digital Banking

Our app and digital banking tools are easy-to-use and give you 24/7 access, but when it’s time to talk to a person, we’re a text or phone call away.

Go Mobile with New Valley Bank

We’re here to help you access all of your online banking needs 24/7 right from the palm of your hand. Our mobile banking app allows you to deposit checks, transfer funds, and make simple transactions from the comfort of your house, office, or anywhere you happen to be. With mobile banking, managing your finances with a personal bank account is more convenient than ever before.

Download our free App today

Available for iPhone and Android Devices. If you are not a current online banking user, please enroll first.

Personal Debit

A personal bank account with great rates and terms—and customer service to match.

Rise Debit

Modern banking for financial wellness.

- No minimum balance required

- $7 monthly service charge

- ATM surcharge rebates up to $10

- Checkless account

Become a Rise Partner

As a Rise Partner, your employer can offer affordable banking right at your place of work, with easier access to their paycheck via a Rise Account, or any other New Valley bank account.

- Dedicated NVRise specialist to assist enrolled employees

- On-site account opening

- Check-free debit account with a $7 monthly fee

- ATM surcharge rebates up to $10